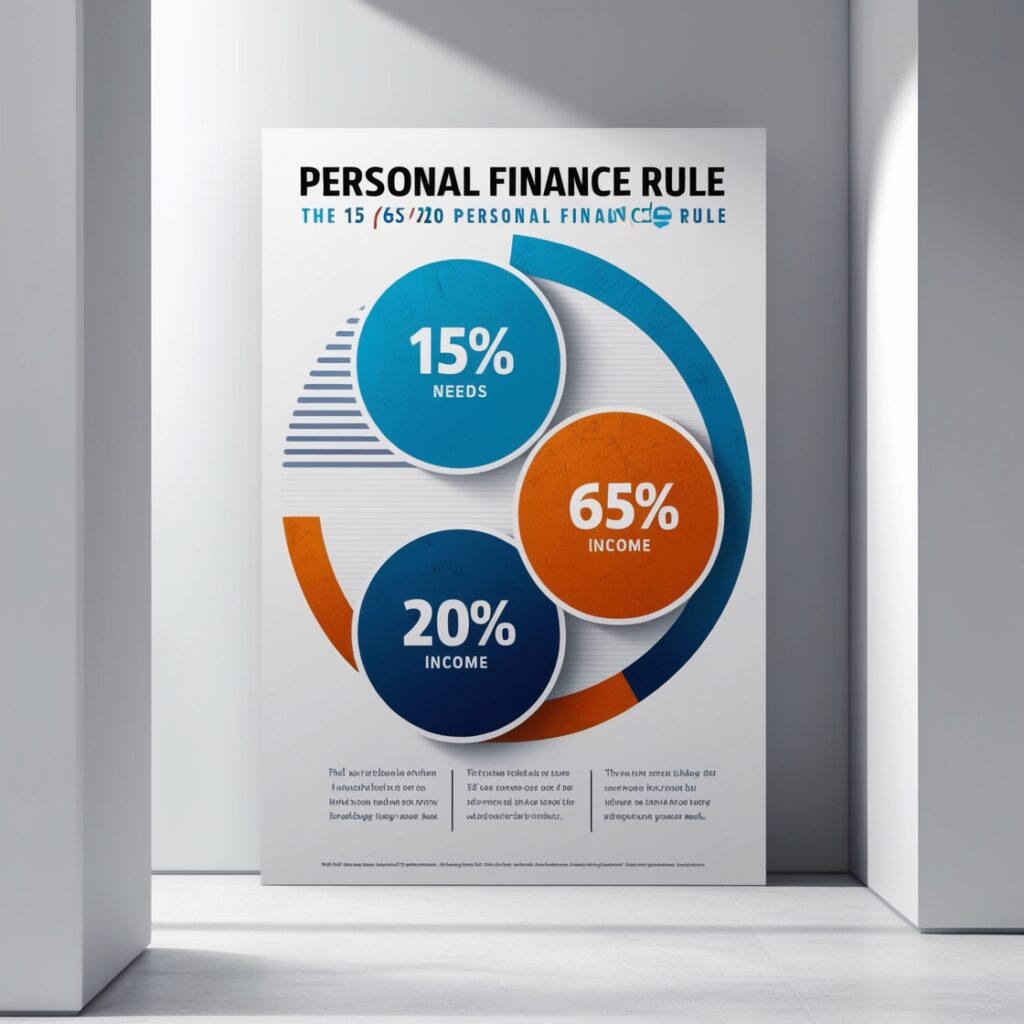

The 15/65/20 Personal Finance Rule

The personal finance rule of 15/65/20 is a simple but effective way of budgeting your income. This model allocates your income into three groups: 15% for saving and investing, 65% for necessities, and 20% for everything else considered as a lifestyle conduct. A more in-depth look at and situational examples of each part of the rule will follow for better application of the rule in practice.

What Is the 15/65/20 Personal Finance Rule?

The 15/65/20 personal finance rule presents a systematic way of looking at how budgeting should be done, thus making it easy to spend one’s incomes sensibly.

- 15% for savings and investments – Saving and making investments should come first in order to facilitate a sound and secure financial future.

- 65% for essentials – This includes monthly expenses incurred in normal everyday activities such as rent, utility bills, and food.

- 20% for discretionary expenditure – Live life to the fullest without getting overboard with spending on things and experiences that are non-essential. Every person has a burden of balancing the economic aspirations which are long into the future and those they want right there and then.

How to Make Personal Finance Rule of 15/65/20 Relevant to You

How to adjust with varying levels of income?

High-Income Earners: People who have higher income may find that they don’t have to spend so much on the essentials that account for the 65% and can save or invest more.

For instance, a person earning $10,000 per month may save 20%, use 50% for essentials, and spend 30% for discretionary purposes.

Low-Income Earners: However, for the persons who earn less, the essentials category may go way beyond the 65%. Such is not even the best case scenario, but it helps to set aside whatever small percentage towards savings.

For instance, adopting a habit of saving 5–10% in a regular fashion can still be beneficial in the long run.

Changing it Depending on Particular Aims

In addition, if you are covering expenses related to the down payment of your house or paying off some debts with a high interest, it is acceptable to spend more than 15% of your monthly income on savings or debt repayment.

Example: Savings or debt repayment 25% of income, discretionary 10% and maintaining essential expenditure at 65%.

15% for Savings and Investments

Setting aside at least 15% of your income for saving and investment purposes means that some money will be carried forward for the future.

Why is this so?

Savings boost a person’s financial position in times of need, whereas investments enhance wealth with rid over time.

Example:

If on average your monthly earnings are equal to $4000 then 15% of such amount equals $600. It can be divided as follows:

- There are 300 dollars that can be put away into an emergency savings account.

- A 401(k) or IRA may receive an investment of 200 dollars.

- Stocks, bonds, or a mutual fund may receive an investment of 100 dollars.

When you save and invest over time, you are not only preparing yourself for any financial emergency that may arise in the future, but also for their longer-term aspirations such as retirement or purchasing a house.

65% for Essential Expenses

This is the most significant component of your financial plan and includes all the aspects needed to sustain your daily living.

What Qualifies as Necessities?

Necessary expenses consist of:

• Cost of housing – rent or mortgage

• Essential services like power, water, and internet

• Transport – fuel, commuting, and vehicle loans

• Food and other food-related items

Illustration

Let us assume you earn $4000 per month, thus 65% of this amount is $2600. Here is how it could be broken down:

• Housing: $1200

• Food: $500

• Basic services: $300

• Travel: $400

• Health coverage: $200

This guarantees that all your basic requirements are met without straining your budget to the fullest.

20% for Discretionary Spending

The last 20% is for luxuries that are not necessary but can spice up or add meaning to your life.

What falls in the category of Discretionary Spending?

Discretionary spending includes all of the following:

- Eating out and leisure activities

- Holidays and business trips

- Personal interests and pastimes

- Monthly payments and other materialistic expenditures

For instance

So out of a 4000$ income, 800$ is 20%. You may want to spend it out as follows:

- Eating Out: $ 200

- Entertainment (movies, concerts): $ 100

- Vacation: $ 300

- Hobbies: $ 200

This category makes it enjoyable to earn thanks to the limit on how much should be spent on it.

Effectiveness of the 15/65/20 Personal Finance Rule

There is Convenience and Order

This rule reduces the hassle of preparing a budget as it gives simple instructions about portioning all the income.

Adaptation

The proportions are constant, but the distribution is flexible. For instance, you are allowed to increase the savings part a little bit if you are aiming for a particular objective.

Promotes Savings Consciousness

Such a framework allows you to avoid the temptations of excess expenditure or procrastination in savings.

How it Is Practiced

Suppose Sarah receives $5,000 every month. With the help of the 15/65/20 personal finance rule she is able:

- To save $750 into her savings account, 15% of her income is appropriated for savings.

- 65% of her earnings- $3,250 is allocated for her monthly expenses such as rent, food and electricity.

- 20% is for Discretionary Spending: $ 1000 goes for vacations, hobbies, and eating out.

This self-imposed limit effectively allows her to keep her spending in check while still enjoying some portion of the income.

Benefits of 15/65/20 Personal Finance Rule

Easy

This rule is an easy way of managing finances as compared to other complex budgeting tricks that can easily be abandoned.

Adaptability

The proportions offer a guideline, however within this structure you can redistribute categories according to your individual circumstances.

Promotes Saving Habit

Saving after earnings becomes a habit when savings of 15% are made from restrictive backup every time.

Promotes Equilibrium

This rule allows spending and enjoyment of other luxuries within reasonable means without being too restrictive.

Tips for Using the 15/65/20 Personal Finance Rule

- Keep Records of Your Expenditure: Management applications should be used to check how far you are getting on with the rule.

- Reassess from Time to Time: Adjust your distributions as your income or expenses grow.

- Savings Should Be Systematic: Create scheduled moves to ensure that you save 15% as required.

- Do Not Create Categories That Embody Each Other: Do not be lenient in determining what may be classified as needs and what may be regarded as wants.

Conclusion: Building Financial Health with the 15/65/20 Rule

The finances of an individual can be governed by the principle of 15/65/20 and financial management is usually realized. This is achieved where 15% is for saving, 65% covers the necessary things and 20% goes to luxuries, all towards creating a better tomorrow without stopping living today.

Use this for a period of a few months, and it is easier to keep in check spending resulting in low stress levels and a well-balanced fair consumption of needs and wants.