Flexible Spending Account (FSA) vs Health Savings Account (HSA): Key Differences and Benefits Explained

Flexible Savings Accounts, or FSAs, Health Savings Accounts, or HSAs, are two parts of the phenomena related to health care that would just not happen in the event that an individual cannot afford any medical coverage. These two saving accounts help people save money towards expenses that they have to pay out-of-pocket but can vary greatly in terms of eligibility, typical contribution amounts a person could expect to receive, and what qualifies as qualified out-of-pocket expenditures. Here, all those points of differences will be thoroughly examined so that one ends up being well informed about which account should be the best fit for his needs.

1.Flexible Spending Account: What is it?

Definition and Purpose

Flexible Spending Accounts might be defined as savings accounts which are established by an employer for an employee to so set aside a portion of pretax earnings during the year for reimbursement of qualified medical expenses. These accounts will help reduce the out-of-pocket expenses incurred during the year and hopefully produce a tax advantage to its users.

How FSAs Work

At benefits enrollment, employees determine a dollar amount that will be contributed to their FSAs for the year, limited by the maximum available to them by IRS regulations.

These are salary deductions before tax, thereby not owing any tax.

Eligible expenses can be incurred for doctor visits, prescription medications, and, in some cases, over-the-counter medicines.

Tax Benefits to an FSA

Since it’s tax dollars that you make less income taxable, you owe less tax because the amount contributed is pre-tax. If, say, a contributor places $2,500 in an FSA and falls within the 30% tax bracket, that person will essentially save nearly $750 in taxes.

2.What exactly is HSA? Health Savings Account

Definition and Objective

Personal Health Savings Account is for everyone enrolled in a high-deductible health plan (HDHP) to save money on future medical expenses. A health account is basically money that you obtain to treat some of the qualified health costs excluded from all other kinds of insurance. Savings are typically for the short term or maybe considered as investing in the longer term.

The way HSAs work

To qualify for one, you must be part of a qualified HDHP.

You can contribute only by you, only by your employer, or both.

Funds in the type of accounts like FSAs that are not used will roll over to the very next year immediately after the year that that has been established. It creates a really good possibilities for health expenditures that may wait to be used in the future.

Tax Benefits of HSA

HSAs provide what is referred to as the triple tax benefit:

Pre-tax contributions lower the taxable income.

All the income earned on investments is tax-free.

Even withdrawals made for qualified medical expenses are tax-free.

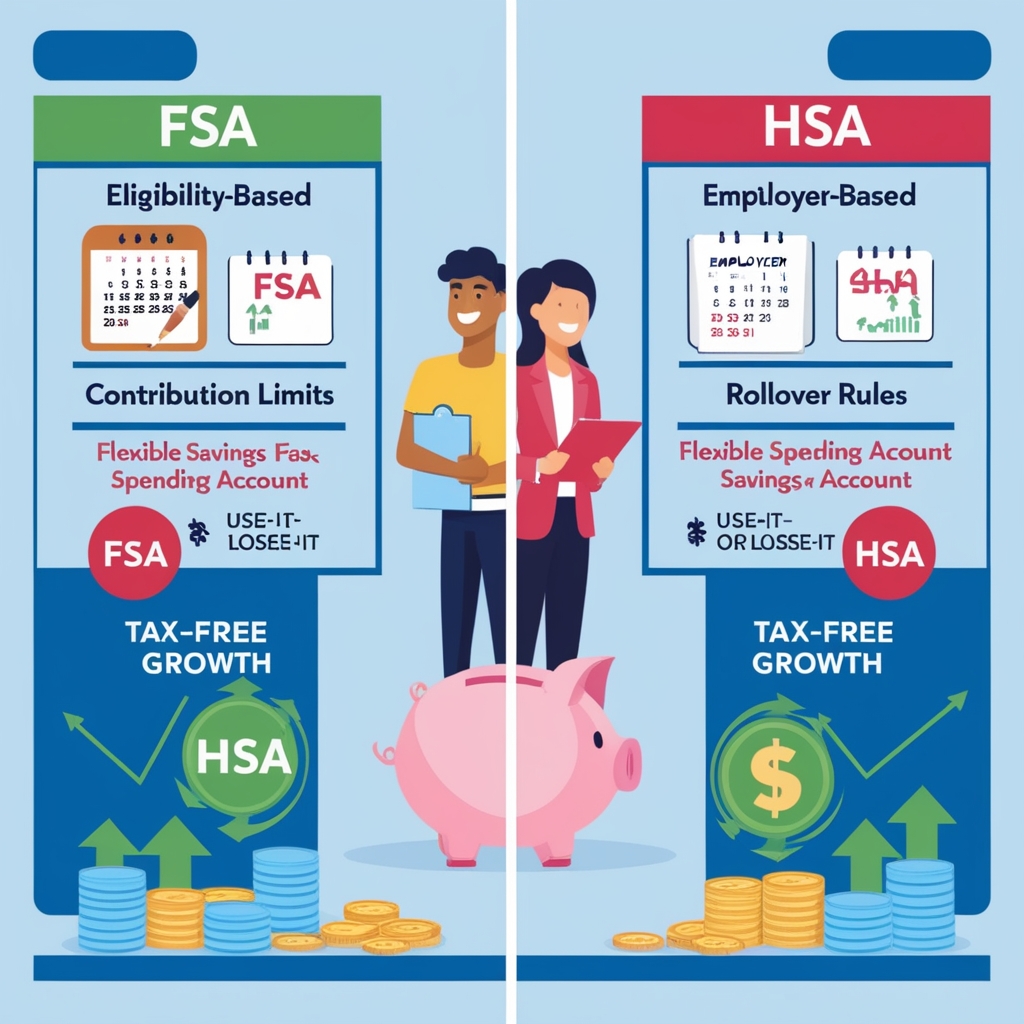

3.Key Differences Between Flexible Spending Account (FSA) vs Health Savings Account (HSA)

Eligibility Requirements

An FSA is generally employer-sponsored, with no specific health insurance prerequisites. People with HDHPs who meet special deductible thresholds are eligible for an HSA ($1,600 individual, $3,200 family in 2024).

Contribution Limits

In 2024, the contribution cap to an FSA extends up to $3,050. HSAs, on the other hand, allow a greater maximum limitation of $3,850 for single individuals and $7,750 for families in the year 2024. In this, an additional $1,000 is available specifically for individuals aged 55 and above as a catch-up contribution.

Policies on Rollovers and Expiration

In general, an FSA actually has a “use-it-or-lose-it” style, only a small rollover option (e.g. for 2024: $610). An HSA never expires, always rolls over, and hence provides benefits and potential savings like none other.

4.Flexible Spending Account (FSA) vs Health Savings Account (HSA): What Works Best for You?

Most Favorable Situations to Select an FSA

Your employer offers an FSA with a rollover option, and you expect frequent medical expenses in the short term.

Not covered under an HDHP, you thereby do not qualify for an HSA.

Best Moment for Opting an HSA

You are under an HDHP and wish to save for immediate and future medical expenses.

Long-term savings vehicle that acts as an alternative retirement fund.

5.Tax Benefits of FSA and HSA

Contributions Towards Saving Salary Taxes

Both an FSA and an HSA allow employees to make contributions before taxes into the accounts, thus achieving a lower taxable income. For instance, he saves hundreds of dollars off his taxes annually by contributing $3,000 to either account.

Growth of Funds in an HSA

Like an IRA or a 401(k), HSAs take that one step further by allowing funds in them to grow —more or less tax-free — through investments. That potential for growth positioned HSAs as one of the most powerful wealth-building vehicles over time.

6.Flexible Spending Account (FSA) vs Health Savings Account (HSA)eligibility

Employment-Based FSAs

Work-based-FSA Generally, an FSA is available for an employed individual. Therefore, self-employed persons and those employees of companies that provide no FSA cannot avail themselves of this service.

High-Deductible Health Plans (HDHPs) for HSAs

For HSAs, the high deductible health plans must be qualified HDHPs. In order to qualify an HSA for opening in 2024 high worth individual thresholds, there is also a qualifying HDHP-an HDHP deductible amount of at least $1600 for individual and $3200 for family.

7.Contribution limits up at 2024

Annual contribution limits for FSAs in 2024

For the year of 2024, the maximum annual contribution for FSAs would be $3,050. Some of the employers may allow employees to carry over as much as $610 into the next plan year.

Annual Limits for HSAs (2024)

HSAs are incredibly generous when it comes to limits: $3,850 per person and $7,750 for a family in 2024. For those aged 55 and older, these limits can also be increased further by an additional $1,000 catch-up contribution.

8.Flexibility in Spending

Qualified Medical Expenses

The expenses covered under an FSA and HSA include many different types of costs, for example: Medication prescribed by a doctor.

Doctor’s visits and hospital visits. Vision and dental care.

Non-Medical Withdrawals

Non-medical expenses cannot be paid using an FSA.

Taxpayers who are less than 65 years old will incur a 20% penalty and an income tax for withdrawing funds from their HSA for nonmedical expenses.

However, upon turning 65, the same taxpayer can withdraw from the fund for purposes he or she desires without being penalized.

9.Combining Flexible Spending Account (FSA) vs Health Savings Account (HSA)

FSAs Limited-Purpose

Limited-purpose FSAs are complementary to HSAs because they usually reimburse dental and vision care. You should maximize your savings.

Maximizing Benefits

A combination of these accounts could care for short-term immediate health care needs (FSA) and create long-term savings (HSA) for someone.

10.Real-Life Examples

How Families Save

Among the several ways families are saving using FSAs, for example, is this: a family with expected healthcare costs (say braces, medications) puts the maximum contribution amount in the FSA to save thousands when pre-taxed dollars are used.

Saving with An HSA by Individual

An HDHP has Jane, a 40-year old, contributing and investing money in her HSA. Because of this tax-free growth in the resulting 20 years, she will have built an excellent healthcare savings plan for retirement.

The nuances of the FSAs and HSAs help to determine the right one that meets one’s individual health and financial needs to maximize savings plus tax benefits.

Conclusion

In which the Flexible Spending Account (FSA) or the Health Savings Account (HSA) would be chosen should be according to the needs of the user concerning health and finances with the possibility of eligibility. FSAs are mainly used to support short-term projected spending while HSAs provide unmatched benefits for long-term savings and investments. Both accounts assist in cutting tax liabilities while making healthcare more affordable. Evaluate your health plan carefully, your anticipated expenses, and financial priorities to find out which account best suits your needs or consider the possibility of combining them. The right savings tool helps you take charge of health expenses and preserves financial security.

FAQs

1. Can I have both an FSA and an HSA?

Yes, if the flexible spending account is limited purpose to only cover vision and dental expenses. That way, you can supplement different healthcare needs to maximize savings.

2. What does happen at the end of the year to any FSA funds still remaining?

Any unused FSA funds would go to waste unless your employer decides to either allow carryover (up to $610 in 2024) or have a grace period to use up leftover funds in that account.

3. Do HSA funds run out?

No, HSA funds roll over indefinitely. Contributions that are not used remain in the account and help you save for upcoming medical expenses.

4. Who can use an HSA?

To be eligible for an HSA, one needs a High Deductible Health Plan (HDHP) meeting the minimum deductions and maximum out-of-pocket limits necessary to be qualified by the IRS.

5. HSA contributions really tax-deductible?

Contributions to an HSA are either done pre-tax through payroll or deducted from your taxable income thereby reducing the amount that can be taxed when you file your taxes.