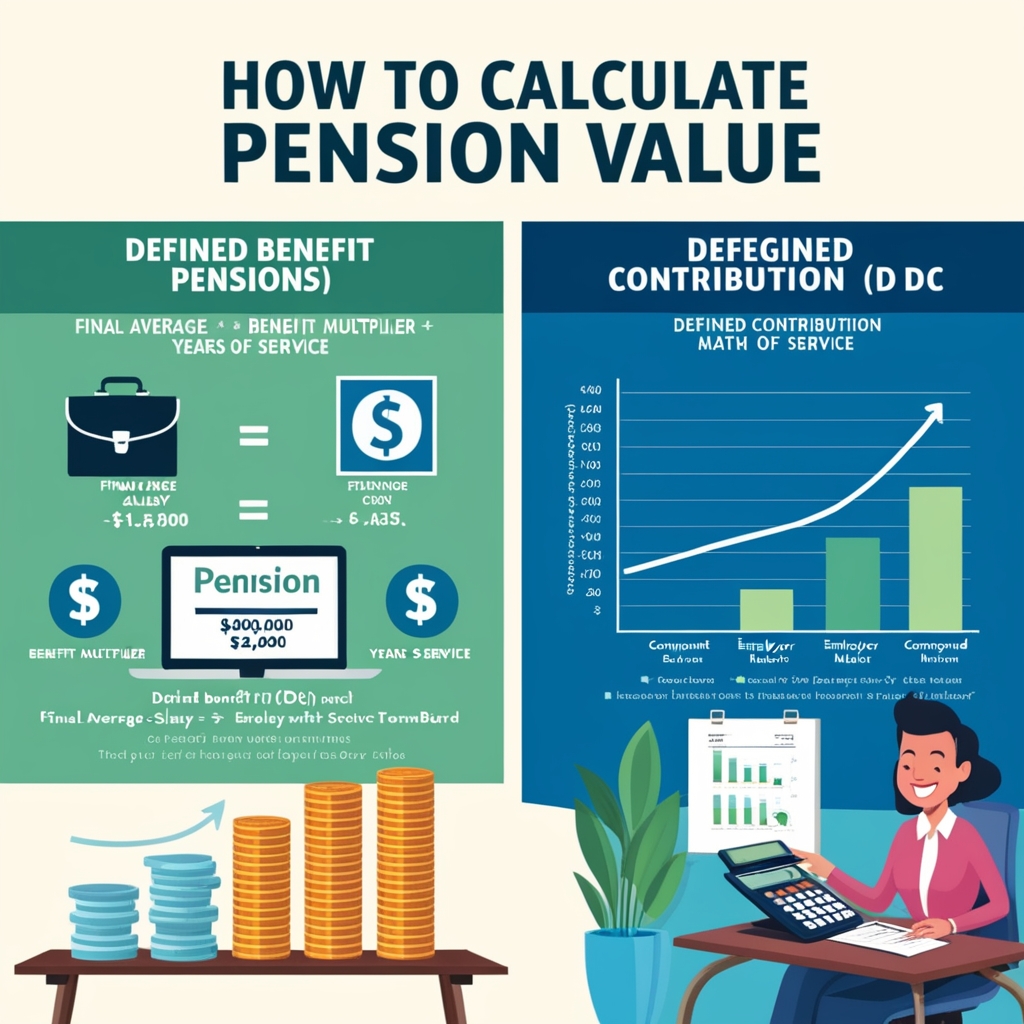

Master Pension Value Calculation with These Easy Formulas and Tips

How to Calculate Pension Value: A Comprehensive Guide Before you can effectively plan for finances nearing retirement, learning how to calculate your pension value is quite important in this guide. Our pages will break down every little thing about this step-by-step procedure for as much needed knowledge as you come across so read through them […]