Inflation and Cost of Living Adjustments

1. Introduction to Inflation and Cost of Living

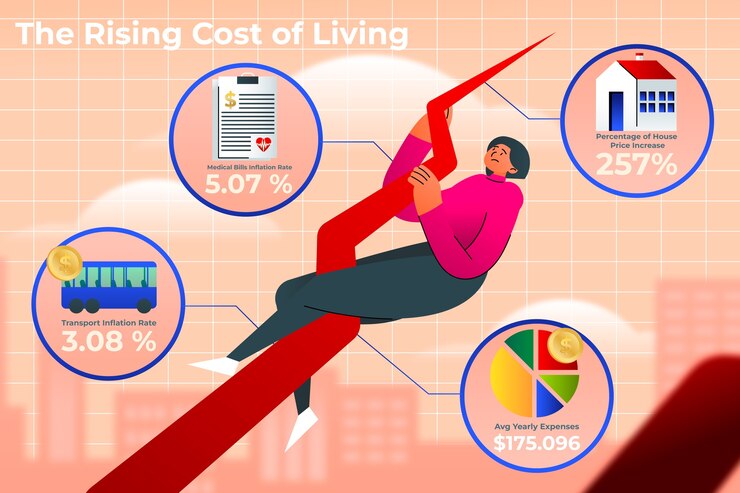

Inflation, or rising prices, is a closely-associated economic phenomenon with the cost of living. Both features prominently in the lives of individuals, businesses, and governments in today’s world.

Defining Inflation:

The price rise in a particular economy is called Inflation. Even at general levels, no economy remains preserved from the price impact. With the passage of time, you will have to pay more even for the exact same product.

Cost of Living Definition:

The cost of living refers to the basis of facts indicating the price necessary to maintain a specific standard of living. It includes the basic expenses covering housing, transportation, healthcare, food, and education.

Importance:

Knowledge of inflation and cost of living helps better the management of finances over time and expects a rise. Consider this; milk costs $2 a gallon in 2000. By 2024, inflation might make this cost look like $4. Thus, the price doubles for the same gallon.

2. Effects of Inflation on Life Cost

A direct result of inflation is that it makes living costly by increasing prices of essential goods and services, thus reducing the value of money.

Influence on Essentials:

1. Housing: Renting or buying a house suddenly becomes expensive when periods of inflation hit.

2. Food: With the increase in transportation and production costs, grocery bills also rise.

3. Healthcare: Cost of availing medical services as well as that of insuring them becomes quite expensive. Real Life Example:

If your annual income remains $50,000, but the same inflation pushes the average price of goods up by 8 percent, you lose out on purchasing power. You would require $54,000 to purchase what you did with $50,000 last year.

Long-Term Effects:

Continued inflation without a corresponding rise in wages causes the quality of living to drop and makes it difficult for people to achieve their financial goals.

3. What is Adjustment of Cost of Living?

A cost of living adjustment (often referred to as a Cost-of-Living Adjustment, or simply as COLA) refers to any change made to income, benefits, or wages, to reflect increases in the cost of living due to inflation.

Main Purposes of COLAs:

The main purpose of COLAs is to prevent deprivation of the purchasing power of persons, especially those who are on fixed chords such as retirees, through the years.

Who Benefits?

• Employees: Some employers provide COLAs to enhance the competitive salary levels of their employees.

• Retirees: Generally, Social Security benefits include an automatic cost of living adjustment that is tied to inflation.

• Government Benefits: Similar adjustments may be made in welfare payments.

Example:

So if a retiree were to receive $2000 a month from Social Security benefits, a new COLA of 5% would adjust the benefits to $2100 to make it comparable with increasing costs.

4.What is an Example for Cost of Living Adjustment?

Cost Value Adjustment, for example, can be made in this manner:

1.So far, Social Security has offered an 8.7% benefit adjustment for its beneficiaries who saw a cost-of-living increase from 2022 to 2023. Thus, for example, a person who was receiving a monthly benefit of $2,500 would now receive $2,717.5.

2.Company COLA: A 3% annual cost-of-living adjustment (COLA) in a company means an employee with a pay of $60,000 receives an annual increase of $1,800 to the new salary of $61,800 to be able to catch up on increases in the cost of living.

3.Government Benefits: SNAP (Supplemental Nutrition Assistance Program) benefits are examples of government benefits which usually adjust the amounts being disbursed based on increased food costs.

They provide away to ameliorate the economy, under rising prices.

5. IRS Cost of Living and Inflation Adjustments

Without a doubt, the IRS also recognizes that inflation evokes an effect on individuals while making tax adjustments each year with the income brackets, contribution limits, and deduction allowance changes. It saves many individuals from being overtaxed courtesy of inflation.

Some Examples of Adjustments Include:

1. Bracket Creep-Inducing Tax Brackets: This has helped prevent the incidence of individuals being taxed more even if the reason for the increase in income is purely inflationary.

2. Retirement Contributions: Inflation-adjusting 401(k), IRA, and other account limits further encourages saving despite inflation.

3. Enhanced standard deductions have cut taxable income and, in turn, reduced the amount taxed.

Example:

For 2024, the contribution limit to 401(k) plans has increased from $22,500 in 2023 to $23,000. This is according to the IRS. This is for the pre-tax saving of more dollars for retirement.

6. Inflation-Adjusted Cost of Living

Inflation adjustment allows for true comparisons of income, investments, or expenses over time, not by sheer nominal values but adjusted for the overall purchasing power.

Why it’s important:

• Offers a clearer understanding of true increase in dollars.

• Make sure that goals are based on real value rather than mere nominal amounts.

Example:

Suppose, for example, that you had a salary of $40,000 in the year 2000, and then adjusted by inflation at present-the figure would be similar to earning $70,000. This is the point of view at which it can be revealed if your earnings actually increased or instead just went with the cost of living.

7. Inflation and Cost of Living Increase

Rising costs due to inflation always lead to increased living costs, as increased production and labour expenses are transferred to the consumers.

Key Areas Affected:

1. Housing: Mortgage rates and rental prices during periods of inflation experience considerable surges.

2. Food and Groceries: Along with price hikes across a variety of staples, bread, milk, and even meat suffer price hikes prices.

3. Movement: The ever-rising price of petrol and increased costs of automobiles continue to pound the pocket of consumers.

Example:

Normally, inflation-during-peak-season months sees rents per month in a metropolitan area increase from $1,500 to $1,800.Thus, it becomes less affordable to have a roof over one’s head for many people.

8. Using CPI to Adjust for Inflation

Consumer Price Index (CPI) is a government tool that basically tracks average price changes over time in a “basket” of goods and services. It is widely used as a measurement tool for inflation and adjustments in wages, benefits, and taxes.

How CPI Works:

• CPI collects data on the prices of different items in various categories like housing, food, and so on, and transports those items.

• An increase in the CPI relates to inflation, resulting in adjustments of income or benefits.

Example:

So, if in a year CPI is increased by 5 percent, then a COLA may be given to Social Security benefits as a COLA by 5 percent to maintain purchasing power.

9. Inflation and Cost of Living Calculator

Online calculators help you understand the effects of inflation on your expenditure and what income bracket you will require to have a similar lifestyle.

Benefits of using calculators:

1. Customized View: Personalized according to your location, income and expenditure profile.

2. Future Prediction: Forecasts expenses against inflation forecasts.

Example:

That is if you use a calculator, a $50,000 salary in 2023 would have to be raised to $54,000 for the same standard of living to be achieved in 2024.

10. Conclusion

No doubt, these are the adjustments that would ensure that people do not compromise on their financial stability. It is thus necessary to understand what these things mean and how one can make use of things like Consumer Price Index (CPI) or Cost of Living Adjustments (COLAs) as tools to offset the adverse effects of inflation while keeping the quality of life intact.

FAQs

1. How does inflation affect a cost of living?

Inflation affects purchasing power. Diminishing individual ability to purchase basic needs like housing, food, and medical care.

2. What is adjustment of cost of living?

A cost-of-living adjustment is designed to compensate income or benefit increases because of inflationary changes allowing their purchasing power to remain constant.

3. An example of a cost-of-living adjustment?

Most of the time, Social Security benefits have associated COLAs which are inflation tied. For example, in 2023, the high inflation rates had an 8.7% COLA applied at that time.

4. How does IRS deal with inflation?

The IRS adjusts the federal income tax brackets, certain contribution limits, and other deductions annually for inflation and to prevent bracket creep.

5. How will measure the effects of inflation on my expenses?

Use inflation calculators or CPI to make an estimate on how price rise will affect your cost of living.

Such substantive exposition makes for a thoroughly complete understanding of the subject while being quite easy to follow. Should you require any such further tailoring, let me know!