1. Introduction: Why Managing Money Matters

It is not only rich men who should learn the art of financial management. Every individual dreaming of freedom must learn to master this skill. Poor money habits cause unnecessary tension, debt, and lost opportunity. On the other hand, money is poorly managed: with a nice strategic 60/30/10 plan, there would be great clarity on how to spend income. That’s how that structured financial habit of the top 1% works – it makes your money work for you, not against you.

Key points:

• How budgeting prevents debt and helps to build wealth.

• The 60/30/10 rule is a practical, easy-to-use system for any level of income.

Example:

“Think of the 60/30/10 rule as your financial GPS-it shows you where your money is going and how to balance expenses, enjoyment and savings.”

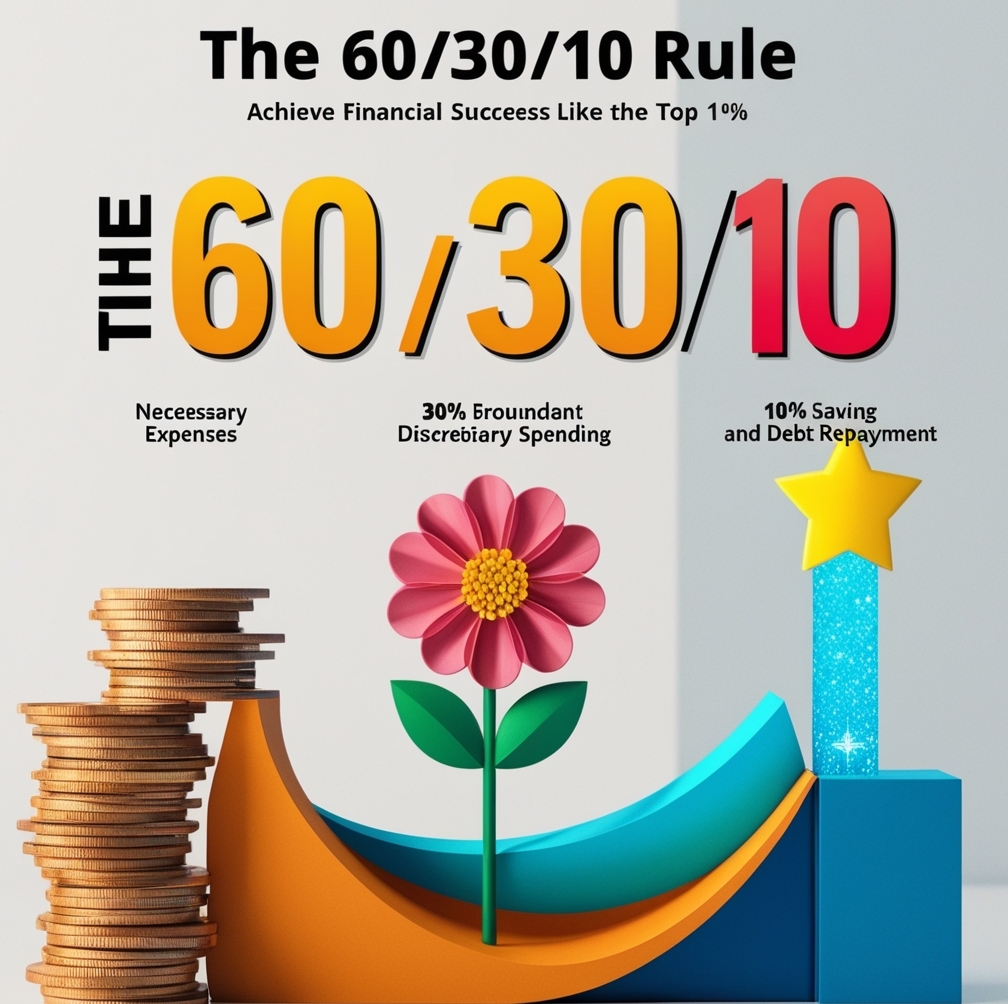

2. What is the 60/30/10 Rule?

The 60/30/10 budgeting rule can be described as an incredibly simple budgeting guideline: it slices your post-tax income into three ways:

-60% for Needs: Essential expenses you can’t avoid, such as rent, groceries, insurance, and utility bills.

-30% for Wants: All non-essential discretionary spending that would make life more enjoyable for you, such as eating out or folly and vacations.

-10% for Savings/Investments: This section serves to make safe your financial future-whether saving for emergencies, retirement, or building wealth with investments.

This rule can be perfectly adapted for every level of income, and can be varied as per requirements. A person who is saving aggressively for a purpose might change it to 50/30/20 for instance.

Example:

“If you have a post-tax income of $4,000 every month:

$2,400 (60%) goes towards all essential expense spends such as rent and groceries.

$1,200 (30%) is spent on fun things such as going out to eat or subscriptions.

$400 (10%) is saved or invested towards the future.”

3. Step-by-step guideline of applying the 60/30/10 rule.

a. Step 1: Calculate Your Monthly Income

What is your total take-home pay after taxes? This may include salary, freelance income, side gig, etc. It’s important to have an accurate number for an effective budget.

Example:

“Your main job pays $3000 a month, your side hustle adds an extra $1000- so your total comes to $4000. Use this amount to allocate expenses.”

b. Step 2: Needs (60%)

These would be the typical necessities that one has to survive with. Start with listing down few vital bills like rent, utilities, transport and groceries.

Pro Tip: If you’re honest about ‘needs’, it could mean that a car payment’s a need because it’s your only option; premium cable channels, say, would constitute a want.

Example:

“Someone earning $5,000 would have needs that basically include:

• Rent/mortgage: $2,000

• Utilities: $200

• Groceries: $500

• Insurance: $300

Total = $3,000 (60%)”

c. Step 3: Prioritize Your Wants (30%)

These generally include expenditures that make life nice but do not have to be spent. Examples of this would include eating out with families, gym membership fees, concerts, travel, etc.

Pro Tip: Guilt-free but budgeted spending. Tracking will help.

Example:

“Allocate $1,500 of a $5,000 income to wants:

• Streaming services: $50

• Dining out: $400

• Shopping: $500

• Travel savings: $550”

d. Step 4: Save or Invest (10%).

This 10% is the door to your financial freedom. It is to be used for building an emergency fund, investing in stocks, or saving for long-term goals. Pro Tip: Automate the transfer into saving or investment accounts so that you never miss this step.

Example:

With $5,000 income, save $500.

• $300 to a high-yield savings account.

• $200 into a low-cost index fund.

4. Advantages of the 60/30/10 Rule

This is a practical and balanced approach to achieving and experiencing life with financial goals. The main benefits include:

· Simplicity: No complicated calculations or endless categories

· Flexibility: Usable for any income and life situations

· Relative Financial Security: Creating the habit of saving so that one is not stress-full during emergencies.

Example:

If a percentage of ten savings is started on income of three thousand dollars and continued into the twenties, by the age of fifty the figure could reach six digits as

a retirement fund with little growth from investments.

5. Common Mistakes and How to Avoid Them

Mistake 1: Underrating Requirements – Needs Many tend to forget about the other expenses, especially the expenses of a medical bill or even car repairs. Take a buffer inside your needs allocation. Correct: Record all each expense for one month, providing the complete picture of your real expenditure.

Mistake 2: Overspending on Wants It is very likely that this amount would be overspent because one’s going to be an impulsive buyer. Fix: Use budget apps to keep tabs and limit the amount of money spent on discretionary items.

Mistake 3: Ignoring Savings Skipping the savings part will only help ruin the planned investment for the long-term future. Fixed: The savings should be automated to make it as a priority.

Example: “Imagine not saving 10% for five years – not only would you be missing out on $6000 per year, but also compounding growth potential.”

6. Real-Life Examples of the 60/30/10 Rule in Action

Sample 1: Newly Graduated from College and Making Thousands

• Basic needs: $1,800 (rent, food, transportation).

• Wants: $900 (eating out, subscription services).

• Saving: $300 (in case of emergencies).

Sample 2: Mid-Career Professional Earning $8,000.

• Needs: $4,800 (mortgage payment, child care, insurance).

• Wants: $2,400 (family vacations, entertainment).

• Savings: $800 (retirement investments).

Pro Tip:

“Most ideally, budget revamps administered regularly should ask for income boosters or life changes, for example when a family begins.”

7. Why the 60/30/10 Rule Works for Everyone

This method of budgeting applies to everyone, and one can adapt it to any level of income or time in life. The beauty of this system is its simplicity and objective balance between needs, wants, and savings.

A. Simplicity in Structure

• The rule is very easy for anyone to understand and be able to implement, except the advanced financial knowledge.

• No advanced financial instruments are involved-the only thing you have to do is to calculate percentages of your income.

B. Universality

• All achieve their mastery intended toward school, work, family, and retirement.

• Works for everyone-you may earn $2,000 or even $20,000, but what matters is the application of its principles.

C. Flexibility

• Percentages are adjustable: for example,

Save more aggressively with 50/30/20, for example.

70/20/10: Adjust if your needs are higher.

Example:

“Although a young professional may use the 60/30/10 rule to juggle student loan payments with leisure and savings, a family saving for a home may switch it to 50/40/10,” says Stirling.

8. Tools and Apps to Simplify the 60/30/10 Rule

Use technology to easily track and abide by the 60-30-10 rule.

a. Apps for budgeting

• Mint-for tracking expenses categorized as need, want, and save automatically.

• YNAB (You Need A Budget): Helps with establishing financial goals and adhering to a 60/30/10 methodology.

b. Spreadsheet Templates

• Simple sheet with columns for income, needs, wants, and savings.

• Automatic calculations with the help of formulas.

c. Automation Tools

• Automatic payments setups: actually directing 10 percent of labor directly to a saving or investment account.

•Distribution by bill pay systems for needs in the great once again.

Example:

‘Apps like Mint can send alerts when you exceed your ‘wants’ budget, helping you stay on track with discretionary spending.’

9. Customizing the Rule for Different Life Stages

A. Fresh graduates or early career entrants.

• Focus on paying loans and keeping an emergency fund.

• If it becomes necessary, change to 50-40-10 for debt payment.

B. Middle-aged professionals.

• Stay at 60-30-10 in order to manage family bills and holidays and save for retirement.

• Proportion your savings upward if pay increases.

C. Retirees.

• Shift to 70-20-10; healthcare plus essentials will fall in the first bucket.

• Less emphasis on active savings and more on investment connectivity.

Example:

“A retiree earmarks 70% for needs such as medical care, parks and recreation, and reinvests about 10% of that 70% into leisure for sustainability.”

10. Advanced Strategies for the Savings/Investment Portion (10%)

The 10% portion saved is expected to settle significantly with wise investments. The allocation can be distributed as follows:

a. First Build an Emergency Fund

• Have about 3–6 months’ worth of living expenses in a high-yield savings account.

b. Invest for Growth

• Invest in inexpensive index funds that reflect the fluctuations of the market over time.

• 401(k) or IRA plans for tax-advantaged savings for retirement.

c. Diversify Investments

• Look at bonds, real estate as well as ETFs (Exchange-Traded Funds) for long-term stability.

d. Automate and Raise Savings

• Automate monthly investments.

• Additionally increase the percentage of 10% to 15% or 20% as the income grows.

Example:

“In the course of thirty years, $500-a-month investment (20 percent of $5,000) into an index fund earning 7 percent a year would yield more than $600,000.”

11. Altering the Rule of Tithing into 60/30/10

Some adjustments in the 60/30/10 rule will be necessary to tackle budgeting and debt issues.

a. Prioritize High-Interest Debts

• Direct a portion of the 10% savings portion to pay off high-interest loans, for example, credit card debt.

b. Consolidate Debts Where Possible

• Refinance loans or consolidate them to lower payments.

c. Apply Debt Snowball or Avalanche Method

• Snowball: Pay off smaller debts first for quick wins.

• Avalanche: Pay down highest-interest debts to save money later.

Example, “Shift to 50/40/10 temporarily, allocating more to needs if paying off a $20,000 student loan while still saving for emergencies”.

Managing Debt Alongside Budget alts an Appropriate Modification of the 60/30/10 Rule:

a. Urgent-Pay High-Interest” Debt- it channels part of that 10% savings in high-interest loan repayments, like credit card debt consolidation.

b. Consolidate the debt where possible, to lower monthly payments through referring or loan consolidation. c. Use the snowball or avalanche method for debts.

• Snowball: Pay off smaller debts first for quick wins.

• Avalanche: Focus on high-interest debts for long-term savings.

For Example: “Shift to 50/40/10 temporarily, allocating more to needs if paying off a $20,000 student loan while still saving for emergencies.”

12. How to Stay Disciplined with the 60/30/10 Rule

a. Track Your Spending Regularly

• Use apps or manually check the expenses in line with the rule.

b. Prevent Lifestyle Inflation

– Keep your needs and wants proportionally equal with income, and put the rest into savings as income increased.

c. Allocate for Irregular Expenses

– Buffers are to be made from the 60% for annual costs like insurance premiums or Christmas shopping.

d. Celebrate Mini-Wins

– Be sure to reward yourself for every milestone achieved in savings into staying motivated.

Example:

“To envision your budget, conduct check-ins every quarter. For example, after accruing $5,000 in savings, dish out a $100 indulgence from your ‘wants’ budget.”

13. Alternatives to the 60/30/10 Rule

If it is not quite the thing you’re looking for, other such methods could serve better in ways of budgeting for you.

a. 50/30/20 finance Rule

• Allocate 50 percent for Needs, 30 percent for Wants, and 20 percent for Savings. This clearly is the more savings-preferred approach.

b. Zero-Based Budgeting

• It means that you assign each single buck in an account a function lest you have any unaccounted money.

• Best For Very Particular Planners.

c. Pay-Yourself-First Approach

• Save / invest a certain percentage in an example say like 20% prior to allotting dollars to other expenses.

Example:

If you are being extremely diligent on saving for a home, this might facilitate a little extra squeezing without as much sacrifice on the wants: moving to 50/30/20.

14. Psychological Effects of the Rule 60/30/10

a. Stress Reduction

• The clear, established financial borders ease anxiety regarding overspending or living on a paycheck-to-paycheck basis.

b. Promotes Balanced Life

• You can enjoy life (30% for wants) while securing your future (10% for savings).

c. Instills Financial Discipline

• Saving regularly while spending within limits over time establishes the habit of creating wealth.

Example:

“Knowing that 10% of every paycheck is building your future creates peace of mind, even during financial challenges.”

Conclusion

The 60/30/10 principle forms the basis for powerful yet simple money management. It divides income into needs, wants, and savings so that one can enjoy a life while it builds security. The increase of income is secondary to wise management of everything earned.

FAQs on the 60/30/10 Rule:

Q1: Can I alter percentages?

A: Sure! A move to 50/30/20 might be in order if you want to save aggressively.

Q2: What if my needs amount to more than 60 percent?

A: Look for ways to reduce costs, e.g. change to a less expensive apartment or turn to public transport.

Q3: How do I manage with irregular income?

A: Use a very conservative estimate of your average income for planning and adjust it when actual income comes in.

Q4: Is savings of 10 % enough?

A: That’s a decent start. Make savings grow as income increases, or invest in a better yield.